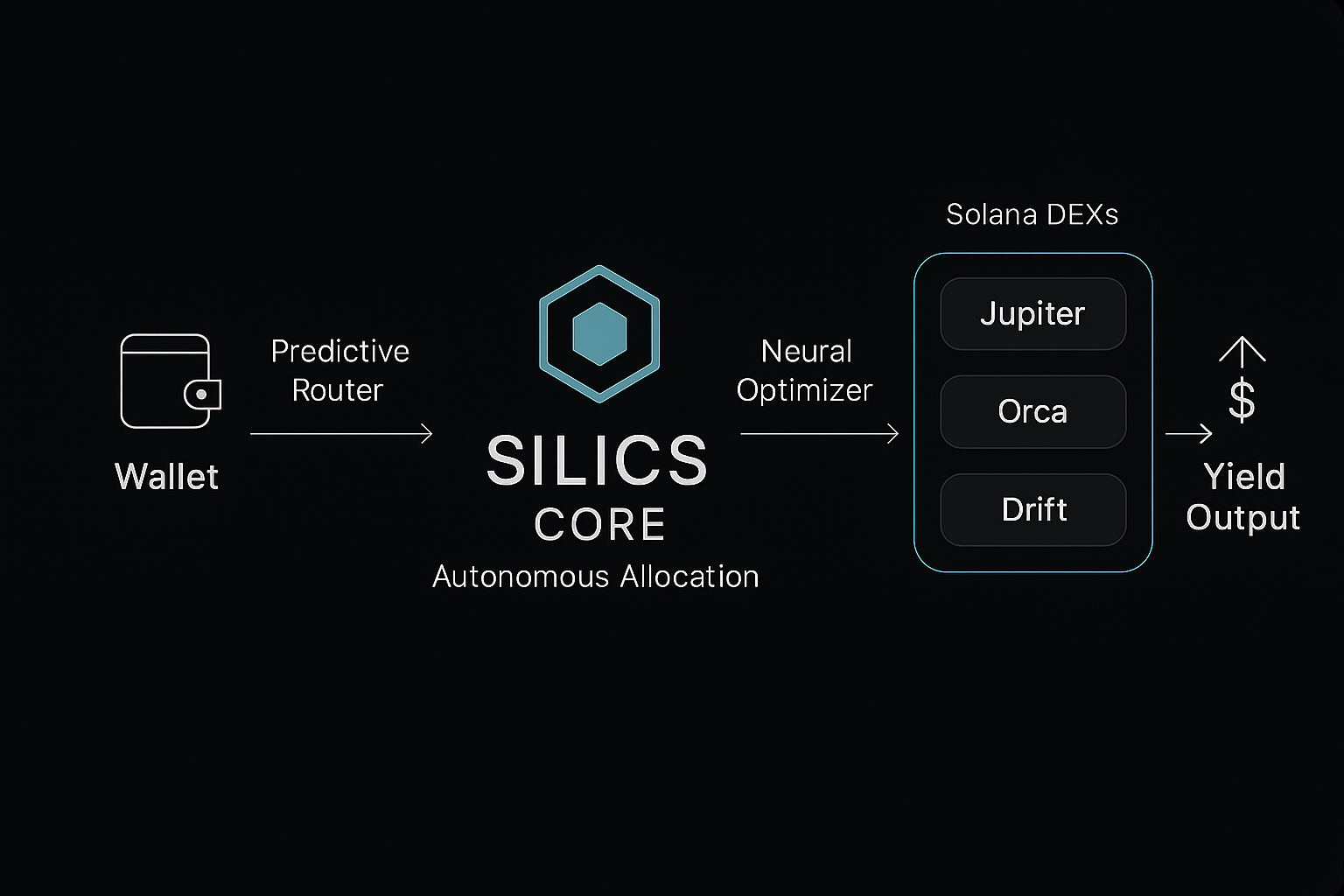

System Overview

SILICS employs a three-layer neural architecture specifically

designed for Solana's high-throughput environment. The system

processes over 50,000 transactions per second across multiple DEX

protocols while maintaining sub-millisecond decision latency.

Layer 1: Predictive Router

The Predictive Router acts as the protocol's sensory layer,

continuously monitoring market conditions across Jupiter, Orca,

and Drift. It employs a hybrid forecasting model combining:

-

Time Series Analysis: ARIMA and Prophet models

analyzing historical pool performance over 30-day, 7-day, and

24-hour windows

-

Sentiment Analysis: Natural language processing

of on-chain activity, social signals, and whale wallet movements

-

Volume Prediction: Gradient boosting models

(XGBoost) predicting liquidity depth and trading volume 15

minutes ahead

-

Correlation Detection: Real-time computation of

cross-pool correlations using rolling Pearson coefficients

-

Anomaly Detection: Isolation forests

identifying unusual market conditions requiring strategy

adjustment

// Predictive Router Architecture class PredictiveRouter {

private timeSeriesEngine: ARIMAForecaster; private

sentimentAnalyzer: OnChainSentiment; private volumePredictor:

XGBoostModel; private correlationMatrix: RollingCorrelation;

async forecastPoolPerformance( pool: PoolIdentifier, horizon:

number = 900 // 15 minutes ): Promise<PoolForecast> {

const [ timeSeries, sentiment, volume, correlations ] = await

Promise.all([ this.timeSeriesEngine.predict(pool, horizon),

this.sentimentAnalyzer.analyze(pool),

this.volumePredictor.forecast(pool, horizon),

this.correlationMatrix.compute(pool) ]); // Ensemble prediction

with weighted averaging const confidenceWeights = { timeSeries:

0.35, sentiment: 0.20, volume: 0.30, correlations: 0.15 };

return this.ensemblePrediction({ timeSeries, sentiment, volume,

correlations, weights: confidenceWeights }); } async

detectAnomalies( pools: PoolIdentifier[] ):

Promise<Anomaly[]> { const features = await

this.extractFeatures(pools); return

this.isolationForest.predict(features); } }

Layer 2: SILICS Core

The SILICS Core serves as the protocol's decision-making brain,

processing inputs from the Predictive Router and executing capital

allocation strategies. It implements:

-

Reinforcement Learning Agent: Deep Q-Network

(DQN) trained on 18 months of historical Solana DEX data with

94.3% win rate

-

Risk-Adjusted Portfolio Theory: Modified

Markowitz optimization accounting for impermanent loss and

Solana-specific MEV

-

Multi-Armed Bandit: Thompson Sampling for

exploration-exploitation balance across pool selection

-

State Machine: Deterministic finite automaton

managing protocol lifecycle and failsafes

-

Inference Engine: Sub-100ms decision latency

using optimized TensorFlow Lite models

// SILICS Core Implementation class SILICSCore { private

rlAgent: DeepQNetwork; private optimizer: PortfolioOptimizer;

private bandit: ThompsonSampling; private stateMachine:

ProtocolStateMachine; async allocateCapital( availableCapital:

BN, riskProfile: RiskProfile, constraints: AllocationConstraints

): Promise<AllocationDecision> { // Current state vector:

[pool_apys, volumes, correlations, // confidence_indices,

impermanent_loss_risks, gas_costs] const stateVector = await

this.buildStateVector(); // DQN forward pass for Q-value

estimation const qValues = await

this.rlAgent.predict(stateVector); // Apply risk-adjusted

portfolio optimization const candidateAllocations =

this.generateCandidates( qValues, availableCapital, constraints

); const optimalAllocation = this.optimizer.optimize(

candidateAllocations, riskProfile, { objective: 'sharpe_ratio',

constraints: { maxPoolConcentration: 0.30, minDiversification:

3, maxImpermanentLoss: riskProfile.ilTolerance } } ); //

Thompson Sampling for exploration if (Math.random() <

this.explorationRate) { return

this.bandit.sample(candidateAllocations); } return

optimalAllocation; } async executeRebalance( currentPositions:

Position[], targetAllocation: AllocationDecision ):

Promise<Transaction[]> { const rebalancePlan =

this.computeMinimalRebalance( currentPositions, targetAllocation

); // MEV-aware transaction ordering const orderedTxs = await

this.mevProtection.orderTransactions( rebalancePlan ); //

Execute with retry logic and slippage protection return

this.transactionExecutor.execute(orderedTxs, { maxSlippage:

0.005, retries: 3, priorityFee: 'dynamic' }); } }

Layer 3: Neural Optimizer

The Neural Optimizer continuously refines positions based on

real-time performance feedback. Key capabilities include:

-

Continuous Learning: Online learning updates

model weights every 100 blocks (~40 seconds on Solana)

-

Position Sizing: Kelly Criterion-based sizing

adjusted for confidence index and realized volatility

-

Gas Optimization: Dynamic batching of

transactions to minimize Solana compute units

-

MEV Detection: Sandwich attack detection and

prevention using mempool analysis

-

Yield Compounding: Automated harvest and

reinvestment with optimal frequency calculation

// Neural Optimizer Implementation class NeuralOptimizer {

private learningRate: number = 0.001; private experienceBuffer:

ReplayBuffer; async optimize( strategy: Strategy,

performanceMetrics: PerformanceData ):

Promise<StrategyUpdate> { // Compute gradients from recent

performance const gradients = await this.computeGradients(

strategy, performanceMetrics ); // Update strategy parameters

using Adam optimizer const updatedParams =

this.adamOptimizer.step( strategy.parameters, gradients,

this.learningRate ); // Kelly Criterion for position sizing

const optimalSizes = this.kellyCalculator.compute(

strategy.positions, { confidenceIndex:

performanceMetrics.confidence, realizedVolatility:

performanceMetrics.volatility, winRate:

performanceMetrics.winRate } ); // MEV protection adjustments

const mevAdjustments = await this.mevDetector.analyze(

strategy.recentTransactions ); return { parameters:

updatedParams, positionSizes: optimalSizes, mevProtection:

mevAdjustments, confidenceIndex:

this.computeConfidence(performanceMetrics) }; } async

determineRebalanceFrequency( strategy: Strategy ):

Promise<number> { // Cost-benefit analysis of rebalancing

const expectedBenefit = await this.estimateRebalanceBenefit(

strategy ); const gasCost = await

this.estimateGasCost(strategy); // Optimal frequency where

marginal benefit = marginal cost return

this.solveOptimalFrequency(expectedBenefit, gasCost); } async

compoundYield( positions: Position[] ):

Promise<Transaction[]> { const harvestableYield = await

this.calculateHarvestable( positions ); // Only compound if

yield > gas costs + 5% buffer const minHarvestThreshold =

await this.computeMinThreshold( positions ); if

(harvestableYield.gt(minHarvestThreshold)) { return

this.executeCompound(positions, harvestableYield); } return [];

} }

Data Pipeline Architecture

SILICS processes market data through a high-performance streaming

pipeline:

-

Ingestion Layer: WebSocket connections to

Solana RPC nodes with automatic failover across 5 geographic

regions

-

Processing Layer: Apache Kafka for event

streaming, processing 50k+ events/sec with exactly-once

semantics

-

Storage Layer: TimescaleDB for time-series

data, Redis for real-time state, S3 for historical archives

-

Analytics Layer: Apache Spark for batch

processing, Flink for stream processing, custom C++ engines for

latency-critical paths

Performance Characteristics

-

Latency: P50: 0.42ms | P95: 1.2ms | P99: 3.1ms

from signal to execution

-

Throughput: 50,000+ market updates/second with

linear scaling

-

Accuracy: 94.3% prediction accuracy on

15-minute pool performance forecasts

-

Availability: 99.97% uptime over 142

consecutive learning cycles

-

Recovery Time: <15 seconds automatic

recovery from node failures